Planful

Gale Force Consulting

Streamline Accounting and Finance from Start to Finish

Trying to corral financial data from every department can feel like an endless job, and if the data isn’t right, it could lead to wrong decisions for your business.

Welcome to Planful. With Planful, you can accelerate access to actuals, quickly create insightful reports and analysis, and manage financial and operational planning.

Let us show you Planful – the solution that brings your teams together for better financial management. Learn how your business can benefit from this comprehensive solution for finance and accounting teams.

Gale Force Consulting

Simplify Financial Processes, Get Deeper Business Insights, and Make Key Decisions Faster

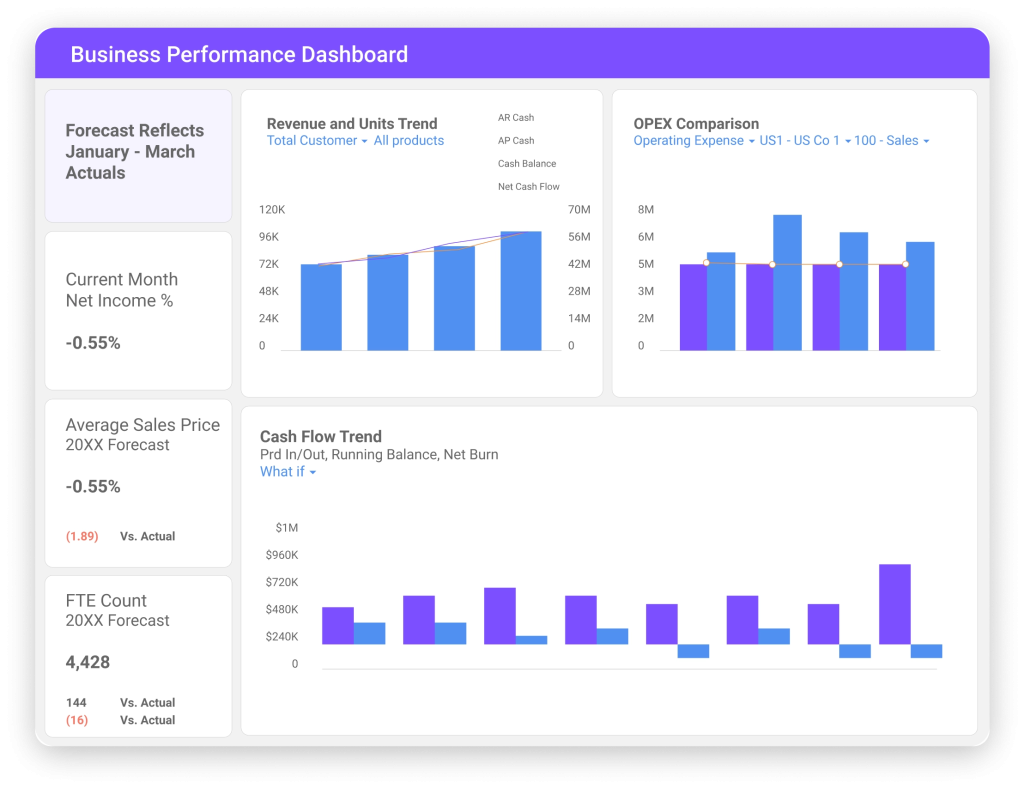

From small businesses to enterprise organizations, companies of all sizes rely on Planful to close their books faster, consolidate data, accelerate reporting, and to build accurate financial plans. Check out just some of the ways Planful allows finance teams to quickly deliver accurate plans, reports, and the insight needed for your business to succeed.

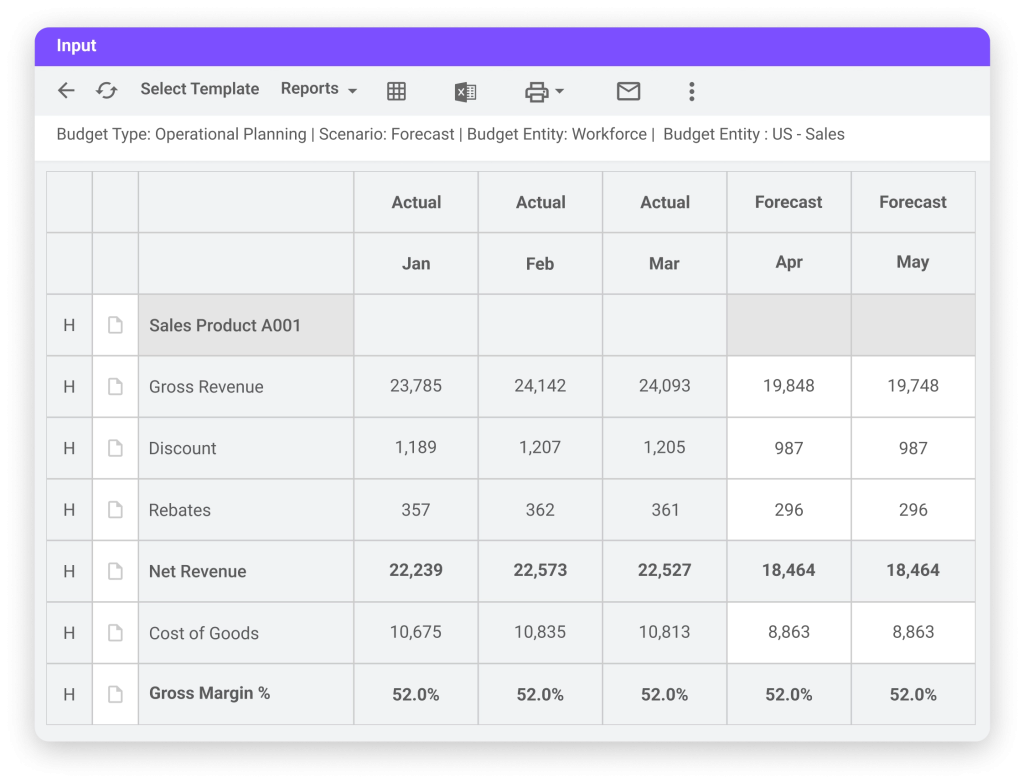

Plan, Budget, & Forecast

Plans, budgets, and forecasts need to reflect the reality of today’s uncertain landscape. Stale data risks missed targets and misallocated resources. Planful makes it easy to gather current data, make insightful decisions, and take action without time-consuming manual processes.

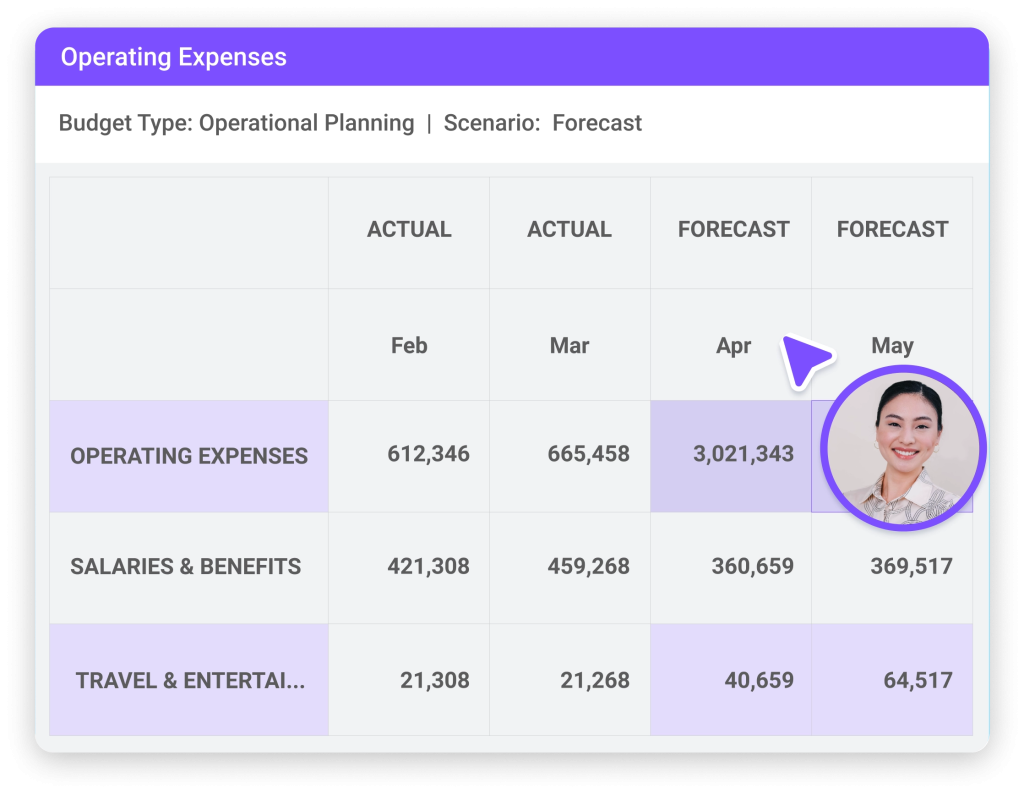

Annual Operating Plans

Your Annual Operating Plan should be a collaborative effort that includes leaders and key stakeholders across your business. The Annual Operating Plan sets the tone for the year and allows your team to align company strategy with business execution. Planful eliminates slow manual processes so you can more easily gather the data needed to make insightful decisions and keep your business focused on the strategy.

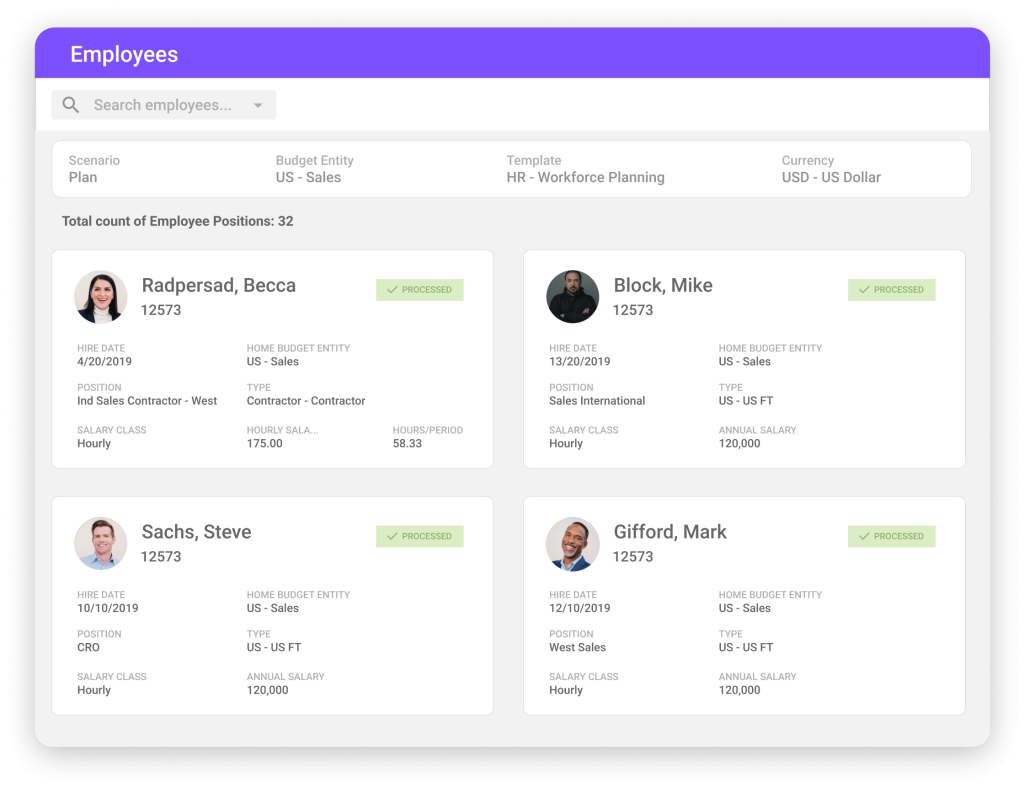

Workforce Planning

Your workforce is both your organization’s greatest asset and its largest cost. It’s often challenging to grow beyond the slow, manual, and disconnected processes that strategically separate HR and Finance teams. Collaboration within your business is critical for addressing talent gaps and business leaders are counting on proper insight to make the right decisions.

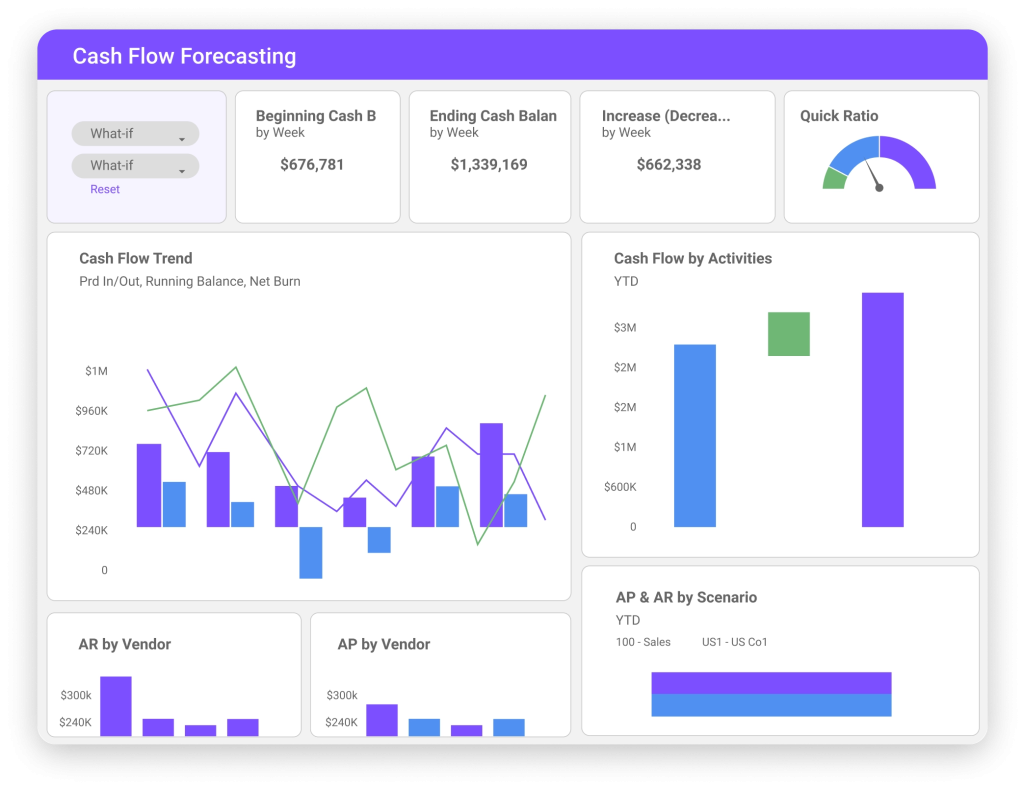

Cash Flow Forecasting

Cash flow is the most critical aspect for protecting and growing your business. But pulling different levers to understand the impact of different decisions should not be a time-consuming manual process. Ambiguous projections or an outdated, inaccurate view of your cash can hinder your ability to provide clarity to the business.

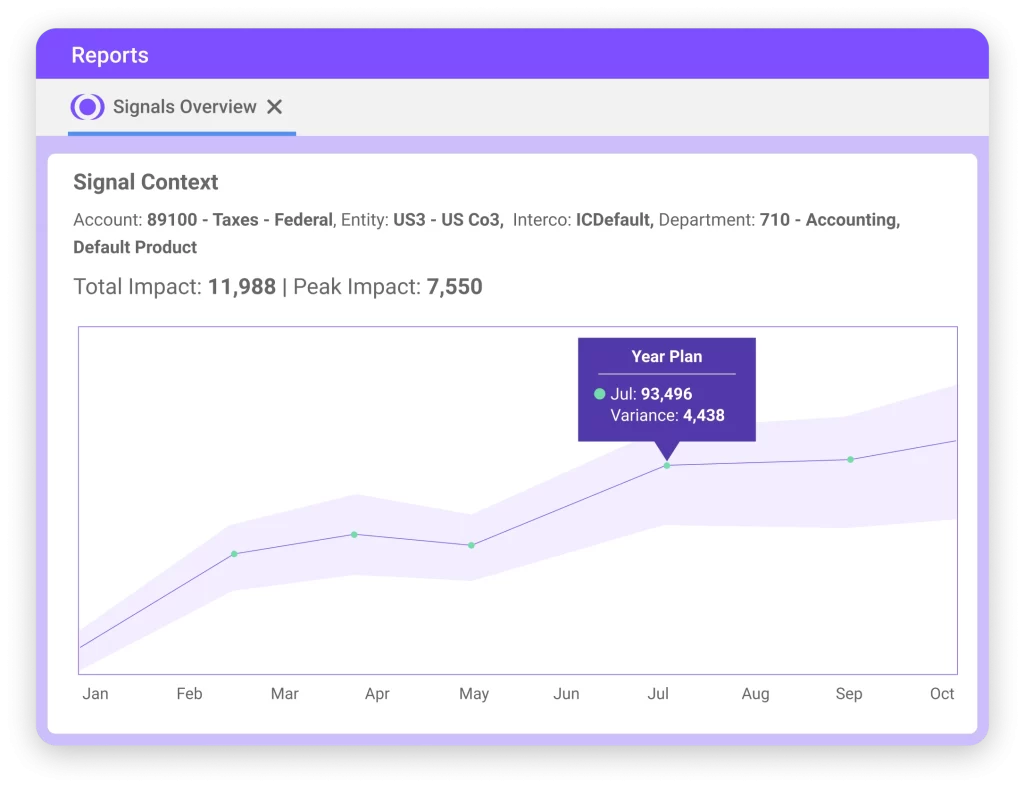

Rolling Forecasts

Annual plans start to go stale on day one because they cannot account for ongoing market volatility and shifting trends. Static information puts your business at risk – especially when you make decisions without adjusting for today’s new insights or reframing future periods.

Scenario Analysis

Ensuring business continuity relies on the ability to rapidly analyze a wide breadth of scenarios that may take place. Business leaders need to make course corrections in a matter of hours or days – not weeks or months. Being trapped in manual processes while trying to account for hundreds of variables across dozens of models puts the business at risk of not seeing a clear path forward when its needed most.

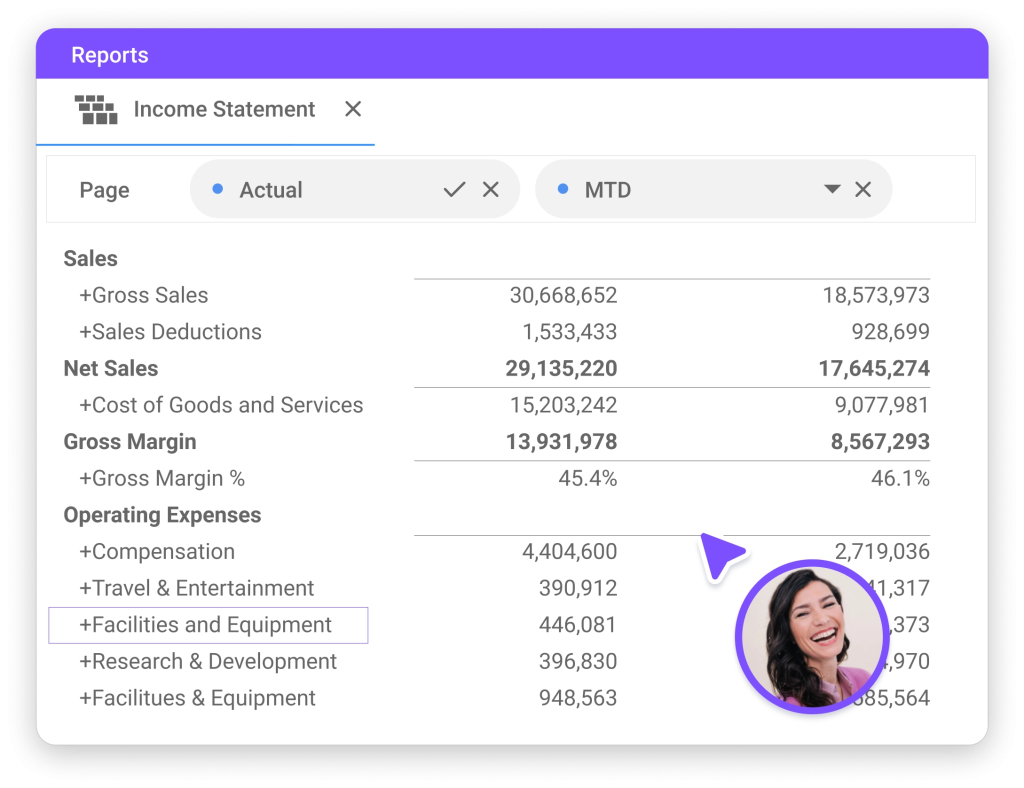

Financial Reporting

Making effective financial and management decisions relies on your ability to investigate trends quickly and to present leadership with insightful information. Planful simplifies the financial reporting process, so your team has the data its needs when it needs it.

Let’s Dive Deeper

Check out this on-demand Planful demonstration for a deep dive of the many capabilities the Planful platform.

Discover how your business can:

- Accelerate budgeting and planning cycles, adopt dynamic planning techniques like rolling forecasts, and empower line managers.

- Accelerate financial close and reporting cycles, improve control and increase confidence in results, and automate the creation of filings, reports, and presentations

- Model what-if scenarios to understand key business drivers, perform interactive query and analysis, and build operational models to align finance and operations

Ready to Find Out How Planful Can Work for Your Business?

Contact the team at Gale Force Consulting Partners and let us show you how Planful can simplify your financial closing processes, provide accurate and timely financial reporting, and help you plan and execute more confidently.

Contact us today for a free cosultation!

Get shelter from the storm with the team at Gale Force. Our experience and passion for helping project-driven companies succeed will put the wind back in your sails.

Copyright © 2023 – Gale Force Consulting Partners, All Rights Reserved.